Creating Medical Billing Reports can Help You Diagnose the Health of Your Practice.

Medical billing reports are a key barometer for understanding what’s going on in your medical practice. Without good reporting, it’s difficult to determine whether your practice is making money or not.

Monthly reports can show you how your medical practice is performing on important revenue cycle metrics, whether claims are being paid in a timely fashion and how well insurance carriers are paying you for key procedures, among other things.

How do you determine which are the most effective reports to run?

How can you determine how well your individual providers are doing?

How can you measure which insurance companies are paying you the most, or at all?

How much money is available in patient collections? In insurance collections?

In this first of a 3 part series, I’m going to take a closer look at some of the most crucial reports I use for our medical practices.

I’ve used these reports for single practitioner practices as well as larger practices with ten, twenty or more providers. Good medical billing analytics can reveal the answers to all of these concerns and are vital to your practice’s financial health.

The Accounts Receivable Aging Report

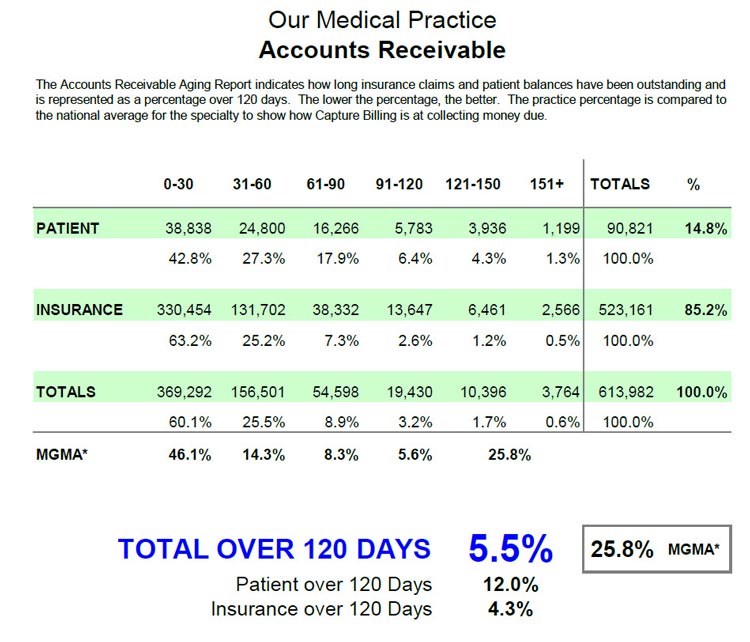

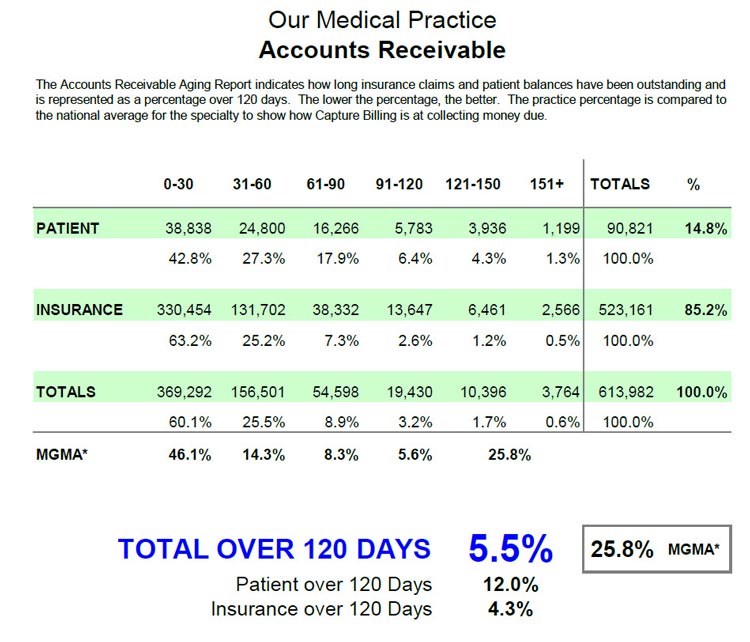

The Accounts Receivable Aging Report indicates how long insurance claims and patient balances have been outstanding and is represented as a percentage over 120 days. The lower the percentage, the better. It’s represented in both a dollar amount as well as a percentage.

With just a cursory glance at the 150 days plus column on this report, an experienced manager or billing clerk can tell whether or not a practice’s billing department is doing well.

Is there a large dollar amount there?

Is there double-digit percentage outstanding?

Let’s Take a Closer Look at the Report

Each AR report can be formatted differently and their appearance may vary. The aging buckets may not look the same in all reporting styles. Some can carry out to 180 days or even 360 days, but they still provide all the same information.

Our report example provided below is broken out into the following buckets: 0-30 days, 31-60 days, 61-90 days, 91-120 days, 121-150 days and 151 days plus.

Your software may break it down differently. We further have separated the amounts due by patient and insurance.

You can see in our example that we have both the patient and the insurance also broken out by percentages.

In addition, we also include a benchmark. This benchmark is a national average against which we compare our practice’s results. This tells us how we’re doing compared to other practices around the country.

In my example here, we’re using the averages from the Medical Group Management Association (MGMA) who publish an annual report benchmarking the AR for different medical specialties. While this report must be purchased from the MGMA, Medicare (CMS) puts out a similar report that is free that can be used as a general benchmark.

In the chart above, we have the total over 120 days as compared to our benchmark. As you can see in this report, our over 120 days for both patient and insurance is 5.5% with an MGMA reported 25.8% being the average of medical practices around the country for this particular specialty.

We further break down the patient over 120 days and the insurance over 120 days. Patients typically take longer to pay than insurance companies, particularly since deductibles have become significantly larger. We are working with patients more often to establish payment plans to assist with those larger deductibles.

Taking a closer look at the numbers

The 0-30 day bucket for both the patient and insurance should be your highest totals. They’re the most current – we just submitted the claims and we’re waiting for a lot of that money.

Your next highest will be the 31-60 day totals. Typically most of the claims due will fall in the 0-60 day period.

The money in the 61-90 bucket should drop off dramatically, especially with your insurance balances. You can see in the example I’ve given here that our insurance percentage for 61-90 days has dropped to 7.3% of the total outstanding insurance balances.

The 91-120 day bucket totals should drop as we work claims, bill patients, do our follow-up and pursue collection efforts, By running this report once a month, you can watch your progress.

Keep your percentage of 121 days or more to a minimum. Make it your goal to work these old claims hard. The old the claim the more difficult it is to collect on. The aim is to keep it in the single digit percentages for over 120 days.

There’s always going to be some money in each of these older buckets. But the key is to make sure that the buckets in the 91 day and higher range are as low as possible. Keep working those claims. Follow-up, follow-up, follow-up.

The AR report is only a tool. There are many other factors affecting these totals. Let’s take a look at some of those factors.

What are Some “Red Flags” to Look For?

In the 0-30 day bucket, one of the factors that could influence the totals could be provider vacations. Having a couple of providers out of the office would account for a lower total in this bucket. But if that number is lower and your older AR stays the same, your days over 120 as a percentage will increase. In balancing these reports, you must take that into account.

Unresolved technical issues with Insurance. Is your practice having issues with a certain insurance company that hasn’t paid for whatever reason? This may leave claims to take two, three or ever four months because of some technical issue that hasn’t been resolved yet.

Unresolved technical issues with Insurance. Is your practice having issues with a certain insurance company that hasn’t paid for whatever reason? This may leave claims to take two, three or ever four months because of some technical issue that hasn’t been resolved yet.

Appeals – which may take months to resolve. There could be multiple appeals, leading to a lot of insurance balances in the 120 or 151 plus days buckets. You’re still constantly working those claims, but they show up as outstanding. So your percentage and amount due may continue to increase but that may be OK.

Is your practice slow to refund patient credit balances? This could influence the patient AR. Common examples of such a credit balance would be when a patient paid a co-pay when they shouldn’t have, or they paid their bill twice. Credit balances can throw off your figures and make them look better than they really are.

Do you have a procedure for writing off accounts sent to collection? Some practices do not write off balances that have been sent to a collection agency. We follow a procedure that takes about 4 months in which patients receive two statements, a collection letter, phone calls and if after all these efforts have been exhausted without receiving payment, their account is forwarded to a collection agency. At that point, the balance is written off, which is proper accounting procedure. Some practices don’t do this, and their 151- plus day bucket becomes very large with money that will never be collected, misrepresenting the percentages.

Report Setup

Practice Management Software systems usually run reports in two ways: by date of service and by responsibility.

Patient AR should always be run according to when the patient become responsible. For example, you get an EOB 45 days after the date of service on which the patient was seen. The EOB indicates that the balance is assigned to the patient’s responsibility because of their deductible. The 45-day mark is when the patient becomes responsible, so the patient AR clock would begin at that time, placing that patient in your 0-30 day bucket. Then factor in any variables as discussed previously to give you a good picture of your accounts receivable.

Insurance reports should always be run by date of service. This will give you a true accounting of how long the insurance takes to be paid.

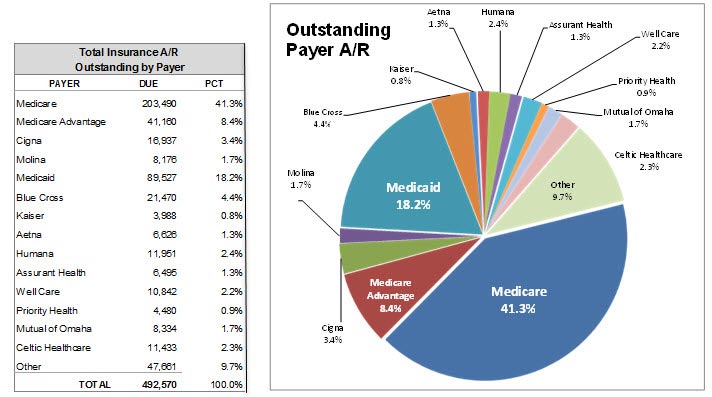

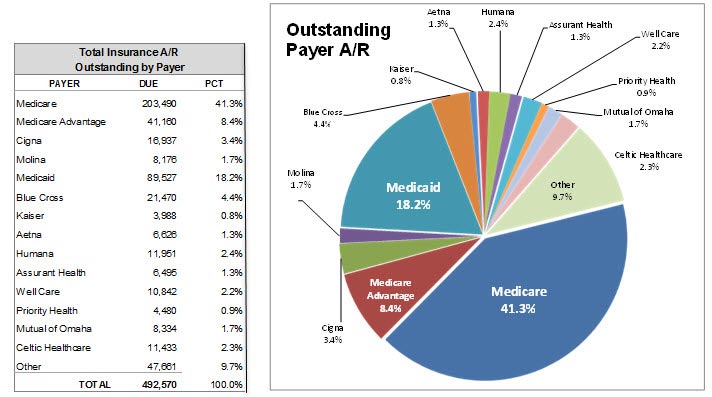

One last thing you’ll see on the report is a breakdown of the individual insurance companies. This gives you a good indication of which insurance company owes the practice the most money and which companies your practice should focus on to recover unpaid or denied claims.

A Word of Caution to Management

One way some billers run the report to make the insurance AR “look better” is to run the report based on date-of-last insurance submission. Practice management systems can re-bill all or some of the old claims in bulk by setting the report parameters to last submission date instead of date of service. This, however, starts the clock over again, putting the old claims in the current 0-30 day bucket, thus making your AR reports look good.

But that’s not real. Make sure your reports are not being done this way.

As part of our medical billing services, Capture Billing offers a variety of customized reports for your practice. All of our reports are prepared monthly and a copy is given to each physician owner and manager.

If you need help with your analysis, give us a call. Get the peace of mind you deserve by knowing that your medical billing is being handled by professionals who get the job done right.

— This post How to Read Your Medical Practice’s Accounts Receivable Aging Report And Why It’s Important to You was written by Manny Oliverez and first appeared on Capture Billing. Capture Billing is a medical billing company helping medical practices get their insurance claims paid faster, easier and with less stress allowing doctors to focus on their patients.

Capture Billing

Unresolved technical issues with Insurance.

Unresolved technical issues with Insurance.