CMS announced over the weekend the launch of a new section on the Quality Payment Program (QPP) website dedicated to clinicians working in small or rural practices, as well as those treating patients in underserved areas. The new page serves as a single point of reference for these clinicians to help them prepare for and actively […]

AAPC Knowledge Center

Laureen shows you her proprietary “Bubbling and Highlighting Technique”

Download your Free copy of my "Medical Coding From Home Ebook" at the top right corner of this page 2018 CPC Practice Exam Answer Key 150 Questions With Full Rationale (HCPCS, ICD-9-CM, ICD-10, CPT Codes) Click here for more sample CPC practice exam questions with Full Rationale Answers Click here for more sample CPC practice exam questions and answers with full rationaleTag Archives: Practices

Best Practices in Radiology Patient Billing

Maximizing the patient experience is no longer limited to the achievement of clinical success. It is a critical component of the new, broader partnership between provider and patient – one that now encompasses conversations regarding not only service quality and cost, but also places a greater focus on practice billing processes in line with the higher demands inherent to the new patient consumerism trend.

6 Tips to Help Practices Charge Correctly for Immunizations

AAPC’s Vice President of Member and Certification Development, Raemarie Jimenez, CPC, CDEO, CPB, CPMA, CPPM ,CPC-I, CANPC, CRHC shared six tips to help medical practices charge correctly for immunizations. Jimenez’s tips are a “must read” for providers, especially family practices and those administering vaccinations annually. She has found that many providers fail to charge for […]

AAPC Knowledge Center

Proper Use of Medicare ABN’s for Radiology Practices

There are circumstances where payment is expected to be denied by Medicare for radiology services to be provided to a Medicare patient. In such cases, the radiology practice must look to the patient for payment. However, without following proper procedures the practice will be precluded from collecting from either the patient or Medicare.

A Program for Successful PQRS Participation for Radiology Practices – Step 7

At Healthcare Administrative Partners, our mission is to educate practices on CMS Quality Programs and provide a path to optimized performance even in the most challenging markets. This is the final installment of our series of articles, “A Program for Successful PQRS Participation for Radiology Practices,” which was specifically designed to help you maximize reimbursement and reduce compliance issues under the Physician Quality Reporting System (PQRS). So far we’ve covered…

How to Read Your Medical Practice’s Accounts Receivable Aging Report And Why It’s Important to You

Creating Medical Billing Reports can Help You Diagnose the Health of Your Practice.

Medical billing reports are a key barometer for understanding what’s going on in your medical practice. Without good reporting, it’s difficult to determine whether your practice is making money or not.

Monthly reports can show you how your medical practice is performing on important revenue cycle metrics, whether claims are being paid in a timely fashion and how well insurance carriers are paying you for key procedures, among other things.

How do you determine which are the most effective reports to run?

How can you determine how well your individual providers are doing?

How can you measure which insurance companies are paying you the most, or at all?

How much money is available in patient collections? In insurance collections?

In this first of a 3 part series, I’m going to take a closer look at some of the most crucial reports I use for our medical practices.

I’ve used these reports for single practitioner practices as well as larger practices with ten, twenty or more providers. Good medical billing analytics can reveal the answers to all of these concerns and are vital to your practice’s financial health.

The Accounts Receivable Aging Report

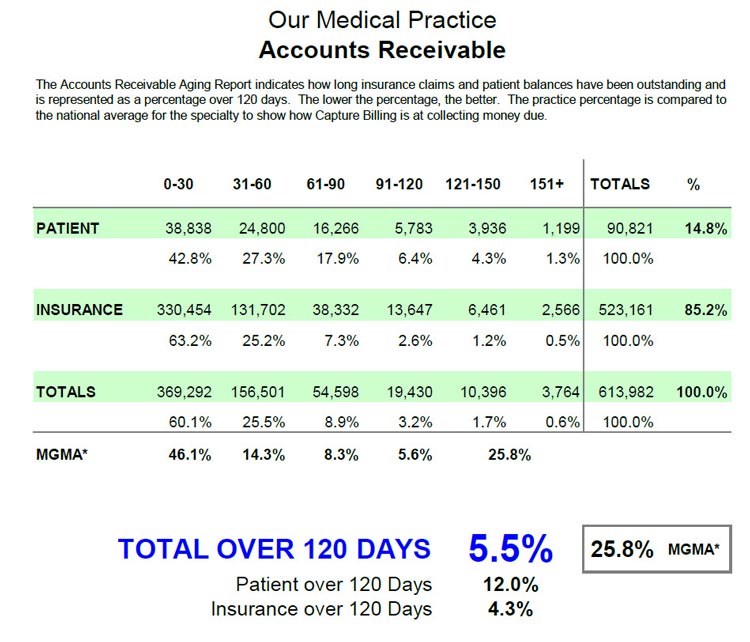

The Accounts Receivable Aging Report indicates how long insurance claims and patient balances have been outstanding and is represented as a percentage over 120 days. The lower the percentage, the better. It’s represented in both a dollar amount as well as a percentage.

With just a cursory glance at the 150 days plus column on this report, an experienced manager or billing clerk can tell whether or not a practice’s billing department is doing well.

Is there a large dollar amount there?

Is there double-digit percentage outstanding?

Let’s Take a Closer Look at the Report

Each AR report can be formatted differently and their appearance may vary. The aging buckets may not look the same in all reporting styles. Some can carry out to 180 days or even 360 days, but they still provide all the same information.

Our report example provided below is broken out into the following buckets: 0-30 days, 31-60 days, 61-90 days, 91-120 days, 121-150 days and 151 days plus.

Your software may break it down differently. We further have separated the amounts due by patient and insurance.

You can see in our example that we have both the patient and the insurance also broken out by percentages.

In addition, we also include a benchmark. This benchmark is a national average against which we compare our practice’s results. This tells us how we’re doing compared to other practices around the country.

In my example here, we’re using the averages from the Medical Group Management Association (MGMA) who publish an annual report benchmarking the AR for different medical specialties. While this report must be purchased from the MGMA, Medicare (CMS) puts out a similar report that is free that can be used as a general benchmark.

In the chart above, we have the total over 120 days as compared to our benchmark. As you can see in this report, our over 120 days for both patient and insurance is 5.5% with an MGMA reported 25.8% being the average of medical practices around the country for this particular specialty.

We further break down the patient over 120 days and the insurance over 120 days. Patients typically take longer to pay than insurance companies, particularly since deductibles have become significantly larger. We are working with patients more often to establish payment plans to assist with those larger deductibles.

Taking a closer look at the numbers

The 0-30 day bucket for both the patient and insurance should be your highest totals. They’re the most current – we just submitted the claims and we’re waiting for a lot of that money.

Your next highest will be the 31-60 day totals. Typically most of the claims due will fall in the 0-60 day period.

The money in the 61-90 bucket should drop off dramatically, especially with your insurance balances. You can see in the example I’ve given here that our insurance percentage for 61-90 days has dropped to 7.3% of the total outstanding insurance balances.

The 91-120 day bucket totals should drop as we work claims, bill patients, do our follow-up and pursue collection efforts, By running this report once a month, you can watch your progress.

Keep your percentage of 121 days or more to a minimum. Make it your goal to work these old claims hard. The old the claim the more difficult it is to collect on. The aim is to keep it in the single digit percentages for over 120 days.

There’s always going to be some money in each of these older buckets. But the key is to make sure that the buckets in the 91 day and higher range are as low as possible. Keep working those claims. Follow-up, follow-up, follow-up.

The AR report is only a tool. There are many other factors affecting these totals. Let’s take a look at some of those factors.

What are Some “Red Flags” to Look For?

In the 0-30 day bucket, one of the factors that could influence the totals could be provider vacations. Having a couple of providers out of the office would account for a lower total in this bucket. But if that number is lower and your older AR stays the same, your days over 120 as a percentage will increase. In balancing these reports, you must take that into account.

Unresolved technical issues with Insurance. Is your practice having issues with a certain insurance company that hasn’t paid for whatever reason? This may leave claims to take two, three or ever four months because of some technical issue that hasn’t been resolved yet.

Unresolved technical issues with Insurance. Is your practice having issues with a certain insurance company that hasn’t paid for whatever reason? This may leave claims to take two, three or ever four months because of some technical issue that hasn’t been resolved yet.

Appeals – which may take months to resolve. There could be multiple appeals, leading to a lot of insurance balances in the 120 or 151 plus days buckets. You’re still constantly working those claims, but they show up as outstanding. So your percentage and amount due may continue to increase but that may be OK.

Is your practice slow to refund patient credit balances? This could influence the patient AR. Common examples of such a credit balance would be when a patient paid a co-pay when they shouldn’t have, or they paid their bill twice. Credit balances can throw off your figures and make them look better than they really are.

Do you have a procedure for writing off accounts sent to collection? Some practices do not write off balances that have been sent to a collection agency. We follow a procedure that takes about 4 months in which patients receive two statements, a collection letter, phone calls and if after all these efforts have been exhausted without receiving payment, their account is forwarded to a collection agency. At that point, the balance is written off, which is proper accounting procedure. Some practices don’t do this, and their 151- plus day bucket becomes very large with money that will never be collected, misrepresenting the percentages.

Report Setup

Practice Management Software systems usually run reports in two ways: by date of service and by responsibility.

Patient AR should always be run according to when the patient become responsible. For example, you get an EOB 45 days after the date of service on which the patient was seen. The EOB indicates that the balance is assigned to the patient’s responsibility because of their deductible. The 45-day mark is when the patient becomes responsible, so the patient AR clock would begin at that time, placing that patient in your 0-30 day bucket. Then factor in any variables as discussed previously to give you a good picture of your accounts receivable.

Insurance reports should always be run by date of service. This will give you a true accounting of how long the insurance takes to be paid.

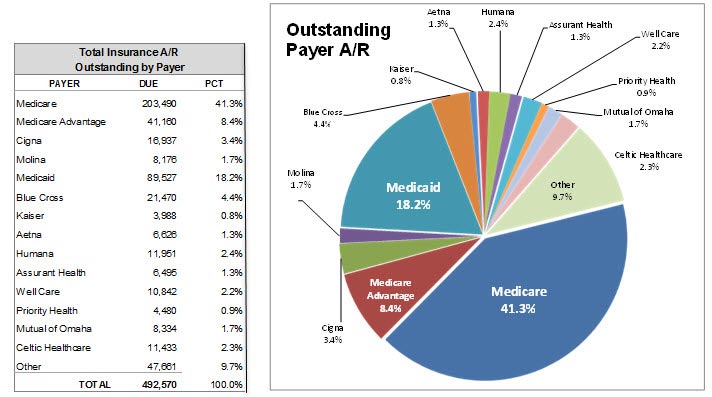

One last thing you’ll see on the report is a breakdown of the individual insurance companies. This gives you a good indication of which insurance company owes the practice the most money and which companies your practice should focus on to recover unpaid or denied claims.

A Word of Caution to Management

One way some billers run the report to make the insurance AR “look better” is to run the report based on date-of-last insurance submission. Practice management systems can re-bill all or some of the old claims in bulk by setting the report parameters to last submission date instead of date of service. This, however, starts the clock over again, putting the old claims in the current 0-30 day bucket, thus making your AR reports look good.

But that’s not real. Make sure your reports are not being done this way.

As part of our medical billing services, Capture Billing offers a variety of customized reports for your practice. All of our reports are prepared monthly and a copy is given to each physician owner and manager.

If you need help with your analysis, give us a call. Get the peace of mind you deserve by knowing that your medical billing is being handled by professionals who get the job done right.

— This post How to Read Your Medical Practice’s Accounts Receivable Aging Report And Why It’s Important to You was written by Manny Oliverez and first appeared on Capture Billing. Capture Billing is a medical billing company helping medical practices get their insurance claims paid faster, easier and with less stress allowing doctors to focus on their patients.

Assessing the Impact of High Deductible Health Plans on Radiology Practices

Before the days of managed care, insurance plans were “indemnity coverage” that reimbursed patients for their out-of-pocket costs. Physicians billed the patients and got paid when the patients felt like making payment, usually only after the insurance company had reimbursed them. Often, the insurance money went elsewhere in the patient’s budget and the physician waited for payment. The not-so-good old days! With the advent of managed care contracting where physicians were paid directly by the insurance company, patient balance collections mostly disappeared. Today the pendulum is swinging back in the opposite direction, requiring practices to once again face the necessity to collect significant balances from patients.

Small Practices May Be Exempt From CMS MIPS Program

The Merit-based Incentive Payment System (MIPS) is a Quality Payment Program that combines the existing Medicare Meaningful Use (MU), Physician Quality Reporting System (PQRS), and Value-Based Modifier (VBM) programs, and adds a fourth component to promote ongoing improvement and innovation to clinical activities. MIPS eligible clinicians must report successfully on defined quality measures and activities […]

AAPC Knowledge Center

How the 2017 Coding Changes Will Affect Diagnostic and Interventional Radiology Practices

The annual cycle of revising codes in the Current Procedural Terminology (CPT)® has been completed with the issuance of the Medicare Physician Fee Schedule (MPFS) Final Rule for 2017. For diagnostic radiology, the changes this year are in mammography bundling, ultrasound screening for abdominal aortic aneurysm, and fluoroscopic guidance. Interventional Radiology (IR) will also be subject to bundling and other rearranging of codes for certain procedures. Finally, there are new codes that have been created to describe procedures previously unlisted, which generally will improve reimbursement for those procedures, and codes deleted from use, which will return the affected procedures to the ‘unlisted’ category.

Medical Billing for Private Practices: Don’t You Want to Get Paid?

You know medical billing is a crucial part of your private practice, but why exactly, is it so vital? There are many reasons that all boil down to the same thing: it’s a matter of survival.

The majority of patients do not pay in full for private practice office visits with cash. Sure, some patients may pay copays by credit card before they leave your office but, in most cases, you must bill the individual’s insurance company for reimbursement for services rendered.

The majority of patients do not pay in full for private practice office visits with cash. Sure, some patients may pay copays by credit card before they leave your office but, in most cases, you must bill the individual’s insurance company for reimbursement for services rendered.

Solo practitioners rely heavily on revenue cycle management, timely submissions of claims, and reimbursement from insurance carriers for their very survival. Unfortunately, it’s not uncommon to find a private practice physician waiting weeks if not months for reimbursement.

Why do private practices struggle with billing tasks?

One of the main reasons why small private practice physicians struggle with medical billing is that a vast number of medical billing companies don’t typically work with small or solo practices. Why? Because these types of accounts are smaller.

The majority of medical billing companies charge a certain percentage of overall collections generated from the billing services they provide Smaller revenues equals smaller profits for the medical billing company. Unfortunately, it’s as simple as that.

So why not hire someone in the practice to take care of the coding and billing? Many doctors do. However, today’s healthcare billing practices can be quite convoluted.

A number of rules and stipulations apply to claims submissions depending on whether you’re billing Medicare/Medicaid, veteran’s insurance providers such as Tricare, or one of the many private healthcare insurance companies in the United States. Each of these carriers has different provisions and guidelines as well as time limits for filing claims.

How important is medical billing for private practices?

It’s especially important for private practices to bill out as quickly and efficiently as possible. Revenue has to be generated in order to keep the office open and meet payroll and expenses. And even doctors need to earn a salary. You need and deserve to be paid for your services.

An overwhelming majority of small and solo physician practices continue to utilize in-house billing with varying degrees of success. Medical billing is vital for a private practice…if the doctor wants to get paid.

In order to get paid, claims for services must:

- Be submitted in a timely manner, and

- Contain the correct codes for procedures, treatments, and services.

If a practice has a healthy revenue cycle management process and a physician pays close attention to it on a regular basis, in-house medical billing may be successful, depending on the experience, qualifications, skills and knowledge of the individuals tasked with coding and billing.

Should you stay in-house or outsource medical billing?

In certain scenarios, in-house medical billing can be more efficient than outsourcing. However, the key is always to generate the highest return on investment. So in most cases, a medical billing company can save you money on overhead costs and employees’ wages, reduce the risk of errors, and provide consistency as well as transparency.

Making a decision to maintain in-house medical billing or deciding to outsource is a decision that must be made with care. Medical billing processes are the bread-and-butter of a private practice. The bottom line is that if you’re not billing for services rendered in a timely manner, you’re not going to get paid in a timely manner.

Even a solo practice or small practice can benefit from outsourcing medical billing in order to:

- Increase cash flow.

- Get paid faster (professional medical billers that focus only on the billing process can reduce errors that result in a claims denial).

- Eliminate significant in-house costs, including a medical biller’s salary, their benefits, the lost productivity cost when they are sick or on vacation, and the specialized computer software they require to perform their job functions effectively.

A specialty-specific private practice can also opt for a billing service that focuses on specific healthcare fields like urology, orthopedics, or oncology. This specialized, focused knowledge of accurate billing codes and procedures can streamline claims processing and facilitate faster reimbursement.

Increasing cash flow

In order to improve and increase cash flow, receive faster payments, and get reimbursed so you can pay your own bills, you can take a number of steps to enhance medical billing efficiency in your practice:

- Whenever possible, utilize your static and mobile EHR technologies to code for services as soon as possible after a patient encounter. This helps reduce incorrect or missing codes.

- Always verify eligibility of benefits and patient demographics to avoid delayed or denied claims. It’s recommended that private physicians check for eligibility at the time the appointment is made. You should also check one to several days before the actual appointment, and again when the patient is in your office.

- Tracking is essential for key performance measures such as accounts receivable, days in accounts receivable, and accounts receivable over 120 days.

- Take advantage of EHR systems that enable you to communicate easily with billers for optimal outcome. Communication (i.e. flags or notes) can assure accuracy and the correct usage of CPT and ICD codes to help streamline claims processing and reduce the amount of denials.

- If you don’t have to time to stay up-to-date or on top of your in-house billing, consult with professional medical billers. At the very least, utilize EHR systems and technologies that incorporate practice management, medical billing and coding, and other customizable options to maximize your potential for timely reimbursement.

- Train staff to collect a minimum of 90% of co-pays at the time of services rendered, which can significantly improve cash flow.

There is no doubt that medical billing software for private practices is essential not only for the health of your practice, but for the health of your own wallet. A number of EHR systems today incorporate practice management software that streamlines workflow and billing processes with an integrated clearinghouse.

They also enable the ability to analyze and manipulate data that helps you stay on top of your practice, your billing and coding practices, and most importantly, your reimbursement rates. After all, you deserve to be paid for the healthcare services you provide.

Does your medical practice have in-house billing or do you outsource your medical billing? Let me know in the comments below.

— This post Medical Billing for Private Practices: Don’t You Want to Get Paid? was written by Aiden Spencer and first appeared on Capture Billing. Capture Billing is a medical billing company helping medical practices get their insurance claims paid faster, easier and with less stress allowing doctors to focus on their patients.